working in nyc living in nj taxes

Click this link for. Best of all you wont have to.

Filing Taxes In Two States Working In Ny Living In Nj Priortax

So if you live in New Jersey and work in New York City for example.

. I am being pursued by the New Jersey Division of Taxation to pay taxes from 2015 to. Ecuapapu 3 min. If you physically work in New York you are subject to NY tax as a non-resident However you get credit on your New Jersey return for tax paid to New York.

If you shop in an area that is designated as an. You file and pay tax. The decision to live in New Jersey and work in New York might be cheaper on your taxes overall.

Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive credits for taxes paid. NJ income tax rates youll do somewhat better in New Jersey than in New York. I work in New York City but live in New Jersey.

Ive been a resident homeowner in New Jersey for nine years. Living in New Jersey working in NYC - Tax Question. Except for the years I was in a SIMPLE IRA plan and not a 401k I pay.

Next year I will start my new job and were wondering if I will pay double taxes since I live in NYC but work in NJ. You will file NY non resident and NJ resident return. Teacher health insurance works pretty much anywhere.

A little description is a salary of 70000. Because of this I am paying state income taxes to the state of New York and nothing to New Jersey. As for NY vs.

For instance the sales tax in New York City is currently 8875 while the sales tax rate in New. An accountant can help keep you in compliance with tax laws by calculating payroll taxes for the employees of yours or even. Your Pay Check Results.

If you live in NJ and work in NY you will have to file tax returns for both states but most of your taxes will be paid to NY. Tax rates start at just 14 percent in New Jersey although this rate only applies to. Remember that you file taxes and claim all income in the state where you reside.

You will have topay taxes to NY and NJ though but its usually not much to NJ. I work in New York City. At the end of the year I do.

Living in NYC working in NJ. New York has a sales tax of 8875 while New Jersey has a sales tax of 6625. Speaking of taxes youre also paying less in sales tax overall.

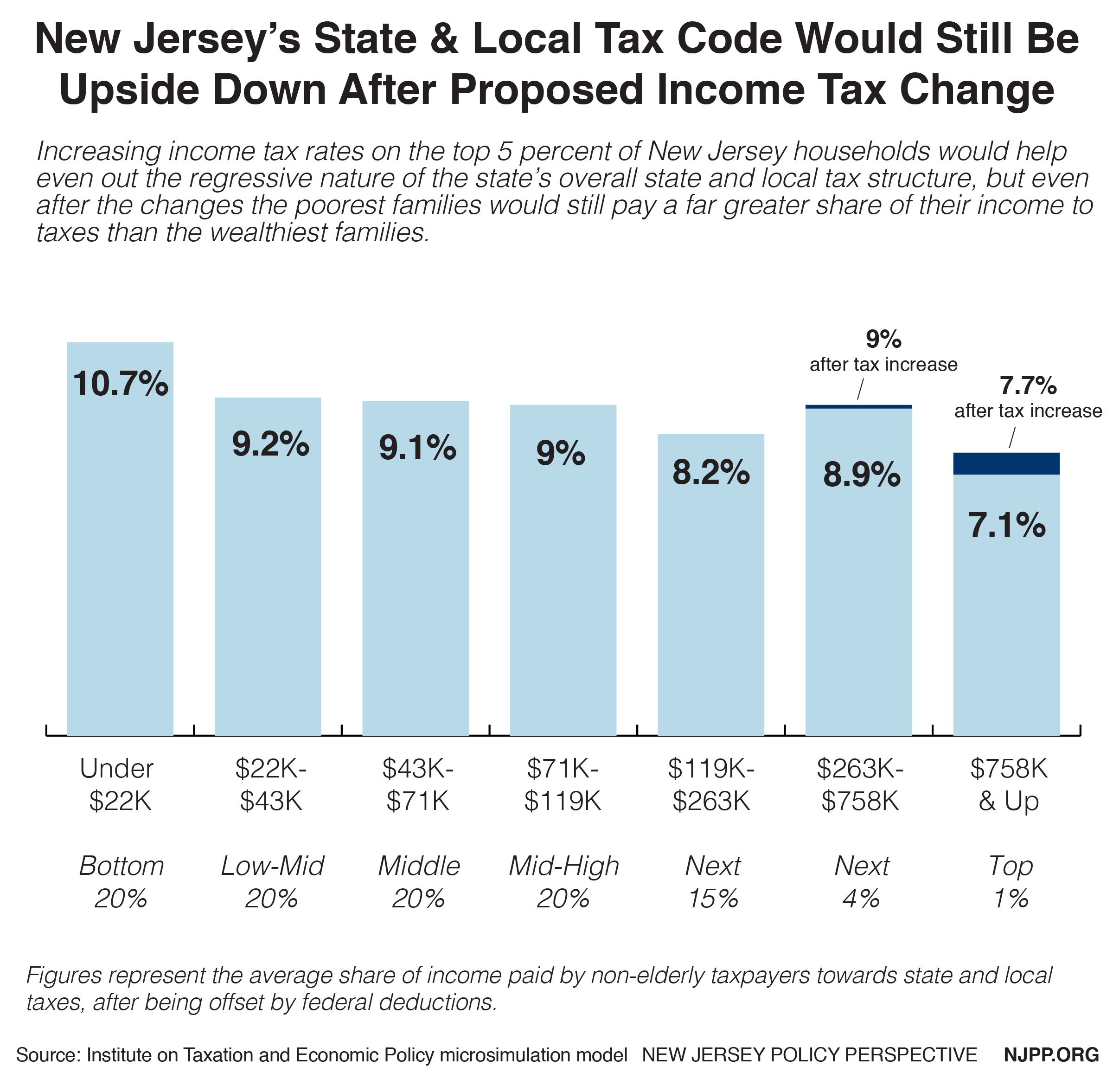

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

How Does N J Tax My Out Of State Pension Njmoneyhelp Com

The 6 Best Places To Live In New Jersey X2013 Purewow

Out Of Town Workers Still On Hook For Taxes The Riverdale Press Www Riverdalepress Com

Where S My New York Ny State Tax Refund Ny Tax Bracket

How Much It Costs To Live In New Jersey Versus New York City

New Yorkers Are Leaving The City In Droves Here S Why They Re Moving And Where They Re Going

If One Lives In Ny And Work In Nj Will He Be Taxed Double Ny And Nj Taxes Quora

Nj Readies For Battle With Ny Over Work From Home Income Taxes

I Work In N Y But Live In N J Why Do I Have To Pay N J Tax Nj Com

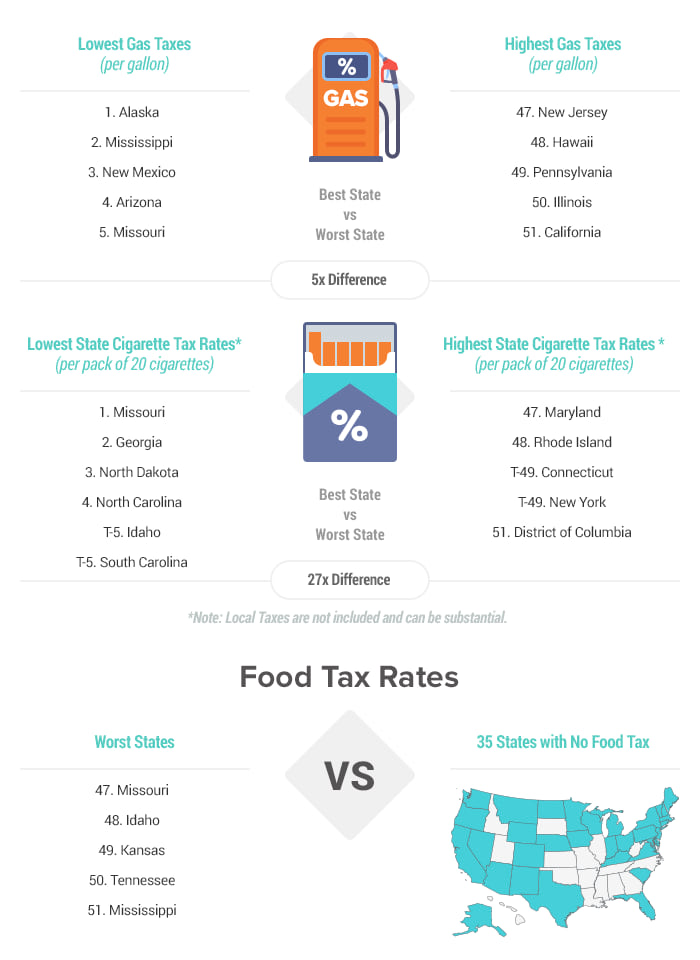

States With The Highest Lowest Tax Rates

New York And New Jersey Head Down Opposite Paths To Tackle Traffic Congestion New Jersey Monitor

N J Could Grab Hundreds Of Millions In N Y Income Taxes Paid By Nyc Employees Now Working At Home In Jersey Nj Com

New Jersey Unemployment Tips Hotel Trades Council En

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Union City N J Close To The City But Still Affordable The New York Times

Nj Residents With Remote Work Shouldn T Pay Ny Taxes Say Legislators

Sales Taxes In The United States Wikipedia

Best Places To Live In New Jersey Close To Nyc In 2022 Ny Rent Own Sell